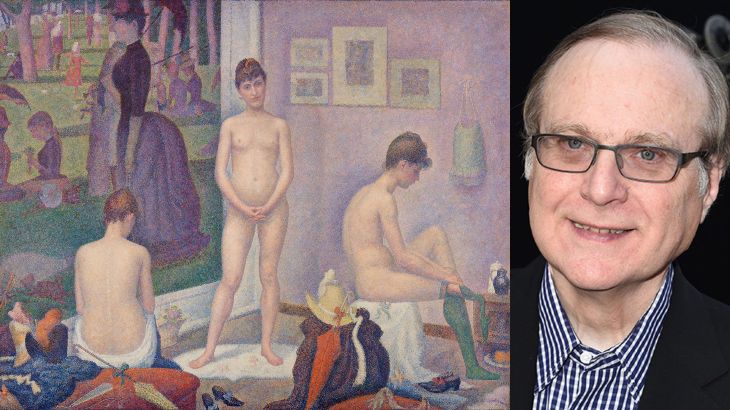

In case you don’t know who Paul Allen is, he is co-founded Microsoft in 1975 with his childhood friend Bill Gates.

One of the things he did with his money was to collect art, to have it stored in his basement, under high expensive security, only to bring it out now, when he sold it in an action at Christies.

The paintings and sculptures owned by late Microsoft co-founder Paul Allen have been sold for a record $1.5bn.

It was the largest art auction in history, according to Christie’s.

The auction house said works by Vincent van Gogh, Georges Seurat, Paul Gauguin, Paul Cezanne and Gustav Klimt each sold for more than $100m, breaking individual records for those artists.

These works were la crème de la crème when it comes to reputation and notoriety. He bought the famous works at reputable institutions and resold at many decades later and made only about 6% compounded return on his investment.

Many people speak about alternative investment as something to consider when thinking about their lives savings.

We already know what happened to other alternative investments such as crypto currencies, gold, and many others. They drastically underperform the market.

The truth is that non productive assets are NOT a great investments.

When it comes to investing for your retirement, or for saving for your kid’s education, there is nothing like investing in the stock market. Not individual stocks, but a market index such as the S&P 500.

In Paul Allen’s case, it really doesn’t matter that he underperformed the market. He could have lost all this art money and still be OK. He was already a billionaire, he was the 37th richest man in the world, according to Forbes magazine, with an estimated $13.5bn. But that’s not the case for most of us who have to worry about financing our lifestyle after we are no longer able to work.

If you are a regular, middle-class person, let me share my formula to accumulate financial success:

1. Start a budget

2. Cut out excess spending

3. Pay off high interest debt

4. Build an emergency fund

5. Open a brokerage account

6. Auto deposit $500 a month (adjusted for inflation)

7. Auto invest in index funds

8. Avoid owning a house

9. Avoid owning a car.

Do that for about 20 years and you will be sitting on a huge pile of money and you will be getting higher returns than 90% of the people out there, and you will be set up for retirement.