My investment strategy is to buy more every time I have more money. I don’t time the market. I know that investments (on the long run) will eventually go up.

No one know when the market will tank or when it will rally. So why waste my brain energy trying to stay informed and anticipate, or react to the market. I just buy and buy some more.

When will I sell? Hopefully never, but the second best answer is: When I retire, when I need the money for personal living expenses. In that case, I will just take the money out when I need it, not when the market conditions are right (we never know when the market conditions are right).

Generally I divide my investment is three parts. 1/3 Canadian stocks, 1/3 US stocks, and 1/3 international stocks.

I don’t know how much money I have made since I don’t know how to account for all the dividend payments I have been getting. But it’s a lot.

Investing in the stock market is safest way to invest your money. Yes, there is day to day volatility. If you learn how to ignore the new, the latest development, the latest emergency crisis, the latest election, you will be OK.

Of course, it’s not easy to avoid all the noise. Media companies spend billions of dollars every year finding new ways to capture your attention. The worst part is that “bad news” is a very potent attention grabbing tool and many people fall victims of it. I have friends who have their money in cash, gold, or silver because the next financial catastrophe is coming. If they only knew how to calculate all the money they have left on the table, it’s worse than any catastrophe they have envisioned.

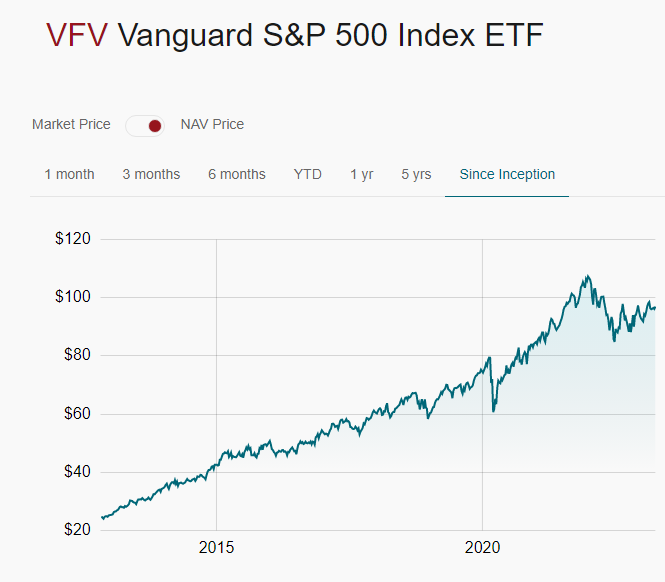

The bedrock of my US investment the the Canadian dollar Vanguard S&P 500 Index, here is the symbol VFV. It trades in the Toronto Stock Exchange. My strategy is to buy some more every December.

The Vanguard S&P is a fund that invests in the stocks of some of the largest companies in the US.

This is a great investment because it’s well diversified and is made up of the stocks of the largest US corporations. These large corporations tend to be stable with a solid record of profitability.

How much money can you earn?

We are not in the business of predicting the future, but here ae some of the past results:

As you can see the rate of return for 3 years is 42%, for 5 years is 66%, and for 10 is 304%. This is best return you can get for your money. This is a great investment opportunity if you have the patience to wait for it.

How to invest in the Vanguard S&P 500

You can buy shared of the S&P 500 as you buy shares of any stock. I buy them through my crappy broker, TD Waterhouse, who still charges me commission when so many other Canadian brokers are allowing ETF transactions commission free (Shame on you TD Waterhouse).

How much does it cost

One of the reasons when the Vanguard S&P 500 is so popular is because of its low cost. It cost 0.08%. That’s $8 for every $10,000. To put it in perspective, most investment vehicles from other financial institutions cost between 2% to 4%. That’s $200 to $400.

Conclusion

The major reason why most Canadian don’t invest in more low cost investments such as the Vanguard S&P 500 is because they don’t know about it, or they get misinformed by ruthless bankers who push more expensive services.

Previous stock market posts