Category: Stock Market

-

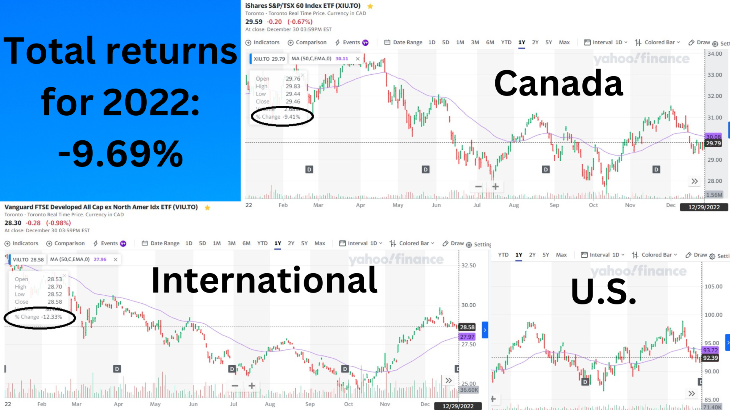

Stock market returns for 2022: -9.69%

in Stock MarketFinancially, 2022 wasn’t so bad of a year after all. We are bombarded with bad news, because bad news attracts viewers and follower to news outlets, but a -10 return for a year is not a catastrophe. In Markets where we see rates of return in excess of 10%, having a negative year should be…

-

5 Reasons Why Focusing on Dividend Stocks May Not Be the Best Investment Strategy

in Stock MarketI see many blogs talking about dividend investment, but dividend investment doesn’t make sense to me, here are five reasons why. Focusing on dividend stocks is a popular investment strategy among income-seeking investors, as it allows them to receive regular payments in the form of dividends while potentially also benefiting from capital appreciation in the…

-

“Buy And Hold,” Money managers don’t follow their own advice

in Stock MarketIf you use a financial advisor you are losing money I quick look at the SPIVA report and you will discover that about 90% of actively managed mutual funds and index funds DON’T beat the index, yet those are the funds all commission based financial advisor will recommend, because those are the funds that pay…

-

The benefits of diversification in a down market

in Stock MarketMany years ago I gave up trying to pick winners and losers in the stock market. I decided to be the market, instead of trying to beat the market. When we look a bit closer at a regular stock market index like the S&P 500, we discover that there are many losers, a whole bunch…

-

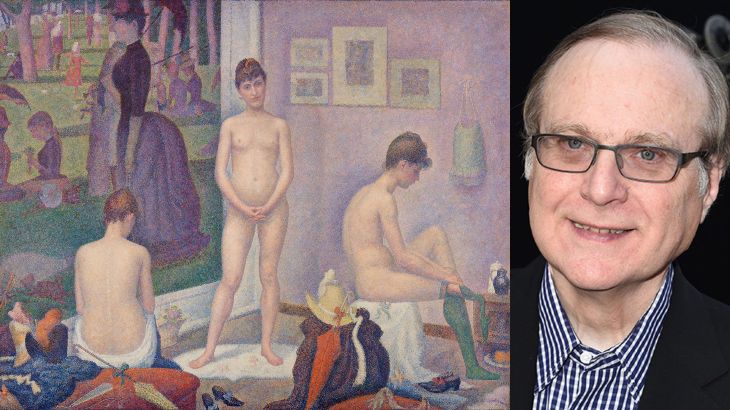

Paul Allen Record-breaking $1.5bn art sale underperformed the market

in Stock MarketIn case you don’t know who Paul Allen is, he is co-founded Microsoft in 1975 with his childhood friend Bill Gates. One of the things he did with his money was to collect art, to have it stored in his basement, under high expensive security, only to bring it out now, when he sold it…

-

Why having bonds in your portfolio is dumb

in Stock MarketIn most personal finance books I have read, the experts suggest a constant rebalancing of a portfolio, shifting from stocks to bonds as we get older. I think that’s the dumbest idea I have ever read. There are two main reasons why rebalancing is such a prevalent idea: The objectives of the clientWhen people invest,…