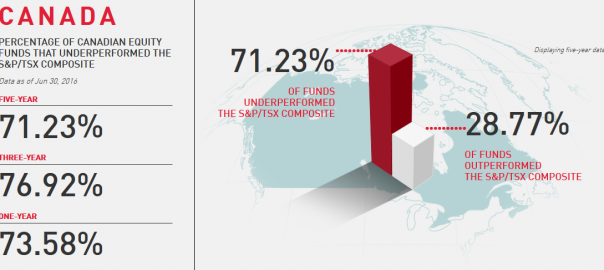

The robots are outperforming humans. According to SPIVA, a research group that measures the performance of mutual funds managers vs passive index, the Canadian Index (S&P/TSX) has beaten active mutual fund managers hands down.

This is how the S&P/TSX had outperformed active managers.

- 1 year: 73.5%

- 3 years: 76.9%

- 5 years: 71.2%

There are many reasons for the index outperforming:

- Management fees are 2% to 2.5% versus 0.10% for index funds. That is a 2% difference. This is a big drag on performance.

- Many managed mutual funds are closet indexers. This means that they tell the public that they do active management but most of the stocks they own are the same as the stocks in the index. So their portfolio is similar to the index and then they slap a 2% markup to compensate for their salaries and marketing expenses.

- Cash drag. Managers keep a portion of their portfolio in cash, they do this to have money for redemption or to be ready for opportunities. Either way, cash money is money that is not working for you.

- Trading expense. It costs money to buy and sell stocks, even in today’s low commission environment, when you buy/sell millions of dollars in stocks, this will add up to the cost.

- Buy & sell spread. When you buy stocks you buy them at the price which they are offered and when you sell them, you sell the at the price someone else is willing to pay for them, this spread between buy and sell is small in big companies and larger in smaller companies, but it is there, always creating a drag on your performance.

- Trailer fees. I call this the kickback which mutual funds pay to advisers who recommend their fund. If an adviser sells you fund XYZ, he will get compensated, every year, for as long as you keep your money in that fund. The trailer fee is generally 1%. This is one percent that doesn’t add to your performance, it goes straight to the adviser’s pocket.

Many investors are waking up to this reality. Thousand of people are dumping their actively managed fund and buying whichever index best represents their investment goals.

Conclusion

If over 70% of actively managed mutual funds don’t beat the index, why pay for inferior performance? Get an index fund and dump your actively managed fund.

Related Posts

- Investing in the US for Canadians

- Pay lower taxes by investing in Index funds

- How to save money while getting fit

Connect with me

I would love it if you connect with me via social. You can find me on Facebook, Twitter, LinkedIn, YouTube, and Instagram.