Category: Stock Market

-

Invest in the Index, not in individual stocks

in Stock MarketEvery day, there are many companies experiencing significant price drops. There is a section on Yahoo Finance called “Day Losers” where the biggest losers of the day are highlighted. Are those good buying opportunities? Maybe. All of our favorite Blue Chip stocks have been part of this list. Some of those stocks have recovered, while…

-

Now (and always) is the worse time to invest in bonds

in Stock MarketAnytime anyone consults a financial adviser, two things typically occur: We’ve discussed point #1 in previous posts. Financial advisers invariably promote funds with high expense fees because they receive kickbacks known as trailer fees, which constitute a significant portion of their income. However, it’s important to note that these trailer fees come out of your…

-

Optimism and compound returns are the keys to stock market success

in Stock MarketOptimism and compound returns are difficult to understand and to teach, but they are the biggest secret to stock market success. How we learn to be optimist At one time in history, people were afraid to get into an elevator that was not controlled by a person. It took decades to understand that it was…

-

Are you beating the Stock Market?

in Stock Market80% of professional investors DON’T beat the market. 90% of private investors DON’T beat the market, yet… most people exaggerate their returns of have selective memory and mistakenly believe that they are beating the market.

-

These three ETFs are responsible for most of my wealth

in Stock MarketI was a day trader for almost 10 years. Oh, I was so smart. I was smarter than the market and all its participants. But I was not, I was delusional. I wasted my time trying to guest the direction of the markets. I had good months in which I felt I was going to…

-

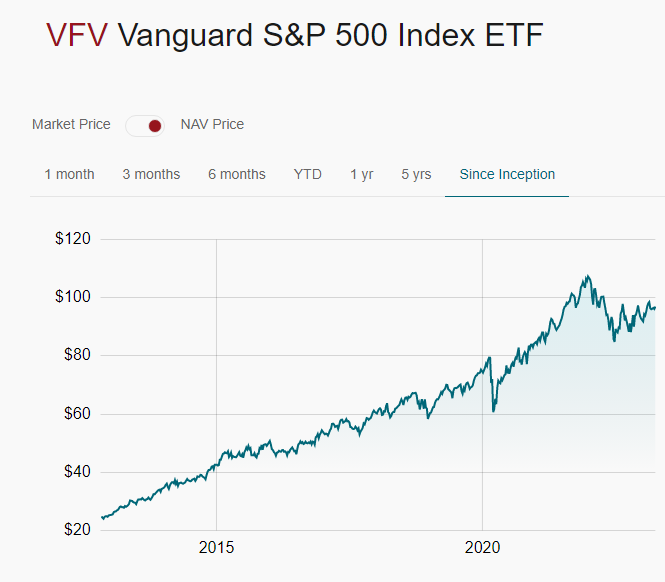

Vanguard S&P 500 is one third of my portfolio

in Stock MarketMy investment strategy is to buy more every time I have more money. I don’t time the market. I know that investments (on the long run) will eventually go up. No one know when the market will tank or when it will rally. So why waste my brain energy trying to stay informed and anticipate,…