Category: Personal development

-

3 Great Tips To Throw A Dinner Party People’ll Love

At some point or another, everyone considers throwing a dinner party. It’s a great reason to have friends over and have a good time for the evening. As tempting as it is, however, not everyone knows how to throw a dinner party their guests will love. There’s quite a bit to look after, so quite…

-

Passion or money? Which one do you choose?

I was watching a YouTube video featuring Influencer Patricia Bright from England, who mentioned that she prioritizes money over passion. One reason she cited is having experienced poverty, compelling her to prioritize financial stability. In my earlier years, I prioritized money, undertaking various jobs unrelated to my passions. I pursued finance and learned stock market…

-

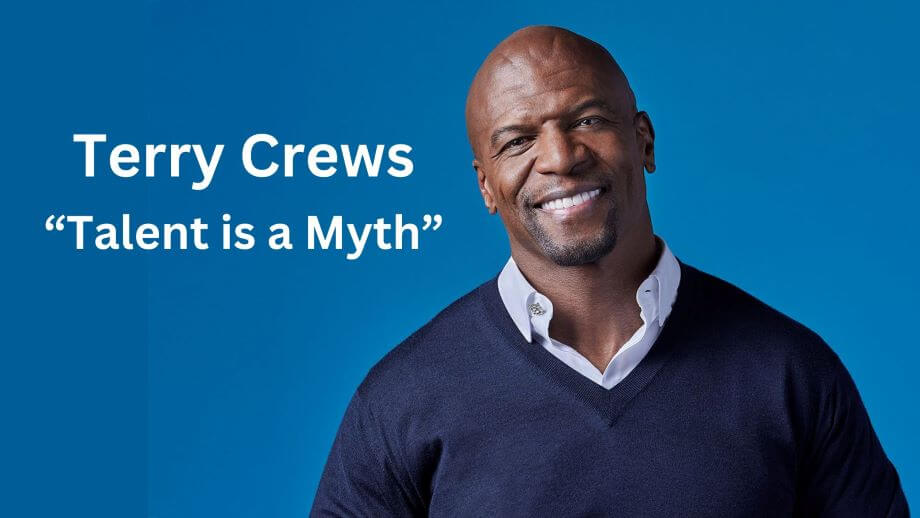

There is no such a thing as having natural talent

That was actor, TV host, and former NFL player Terry Crews. Those were his comments when he was told that he was a natural at acting. He refuted the idea and went on to tell us about the many hours of practice he does every day in order to improve his craft. I believe that…

-

Nobody owes you anything, not their business, nor their friendship; you have to earn it

As an entrepreneur, it’s important to understand that nobody owes you anything. Success in business often depends on creating a product or service that people want, on the relationships you build along the way, and on your endurance to stay in business long enough to see it succeed. Many times you have a good idea,…

-

Ryan Serhant, from drama student to real estate millionaire

Ryan Serhant is one of the most successful and well-known real estate brokers in the world. He was a theater student who waited tables to pay his rent. Out of desperation he turned to real estate. He currently stars on the TV series Million Dollar Listing New York Through a combination of hard work, personal charm, and…