Month: April 2017

-

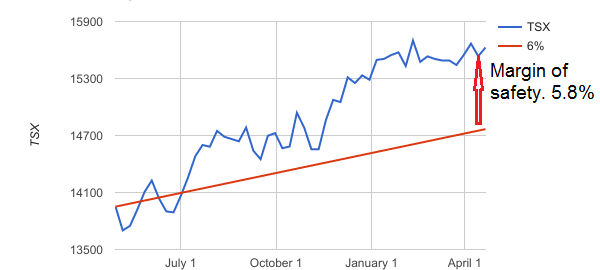

How I deal with not having bonds in my portfolio

I want to share what are my market expectations and how I deal with not having bonds in my portfolio. Ever since I started studying finance I have learned a few recurring themes: Over the long run, stocks outperform bonds People add bonds to their portfolio to reduce volatility What are my portfolio expectations A…

-

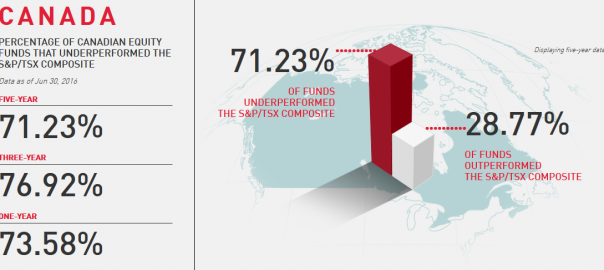

Passive investment outperforms active managers in and outside Canada

The robots are outperforming humans. According to SPIVA, a research group that measures the performance of mutual funds managers vs passive index, the Canadian Index (S&P/TSX) has beaten active mutual fund managers hands down. This is how the S&P/TSX had outperformed active managers. 1 year: 73.5% 3 years: 76.9% 5 years: 71.2% There are many…

-

Investing in the US for Canadians

My portfolio is ⅓ Canadian, ⅓ US and ⅓ international. In addition, the US portion is in US dollars. Most investors, all over the world, have a country bias. They like to invest in what they know and of course, they know their national companies therefore that’s where they invest. It is important, especially for…

-

Pay lower taxes by investing in Index funds

Taxes are our biggest expense Our biggest expense is neither food, nor housing, nor transportation. No, our biggest expense is taxes. Here in Canada, we have many privileges not found anywhere else in the world. We have a stable government, low crime, acceptable medical service, job opportunities, etc. But we pay dearly for all those…