Year: 2014

-

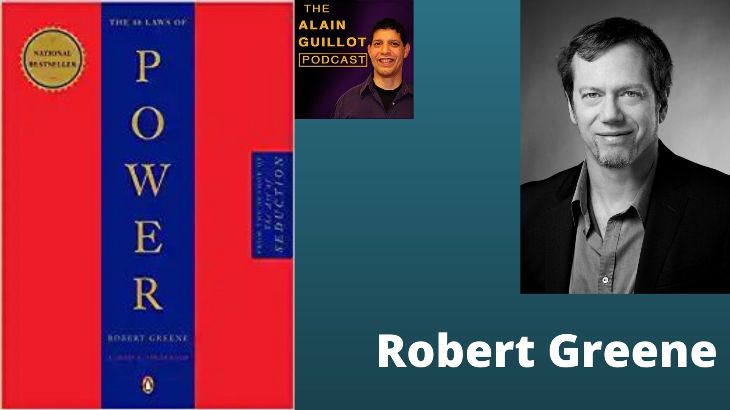

The 48 Laws of Power by Robert Greene (Book Review)

Once again, I listened to the book on my Android phone and after many hours of meditation, I’m still not sure whether the author wanted us to absorb his message literally or if he was highlighting the absurd. Robert Greene tries to teach us how to obtain power by cunning, manipulation, and lying. He states…